Worthwhile

Get a straightforward, fast service on-the-go. One document is all you need

Get a straightforward, fast service on-the-go. One document is all you need

A direct lender committed to responsibility and innovation. We keep your data confidential and help in hard times

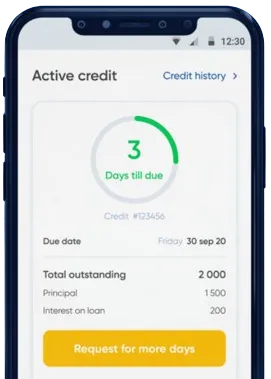

Easy, quick fixes from the comfort of your home. Instant transfer and loan extension opportunities

Use the app to send your request, simply fill in the form.

Wait briefly for our decision, typically 15 minutes.

Obtain your funds, usually taking only one minute to transfer.

Use the app to send your request, simply fill in the form.

Download loan app

When faced with unexpected expenses or financial emergencies, many individuals in South Africa may find themselves in need of quick and convenient access to cash. While traditional bank loans may require extensive paperwork and lengthy approval processes, easy payday loans offer a convenient alternative for those in need of immediate financial assistance.

One of the primary benefits of easy payday loans in South Africa is the convenience and accessibility they offer to borrowers. With online application processes and quick approval times, individuals can access the funds they need in a matter of hours, rather than days or weeks. This accessibility makes payday loans an attractive option for those who need quick cash to cover unexpected expenses or emergencies.

Additionally, payday loan providers in South Africa often have flexible eligibility requirements, making it easier for individuals with less-than-perfect credit scores to qualify for a loan. This accessibility ensures that those in need of financial assistance can access the funds they need, regardless of their credit history.

Another benefit of easy payday loans in South Africa is the flexibility they offer in terms of repayment options. Borrowers can choose the loan amount and repayment term that best suits their financial situation, ensuring that they can repay the loan on time without causing further financial strain.

Additionally, some payday loan providers offer the option of extending the repayment period or rolling over the loan, providing borrowers with additional flexibility in managing their finances. This flexibility can be particularly beneficial for those facing unexpected financial challenges or fluctuations in income.

Unlike traditional bank loans, easy payday loans in South Africa often come with transparent fee structures, making it easy for borrowers to understand the costs associated with borrowing. Before agreeing to a loan, borrowers are provided with clear information about the interest rates, fees, and charges involved, ensuring that they can make an informed decision about their borrowing.

Overall, easy payday loans in South Africa offer a convenient and accessible solution for those in need of quick cash to cover unexpected expenses or financial emergencies. With quick approval times, flexible repayment options, and transparent fee structures, payday loans provide a valuable financial resource for individuals facing temporary financial challenges.

Easy payday loans in South Africa can be a beneficial option for individuals in need of quick and convenient access to cash. With their accessibility, flexibility, and transparency, payday loans offer a valuable financial solution for those facing unexpected expenses or emergencies.

A payday loan is a small, short-term loan that is typically repaid on the borrower's next payday. These loans are designed to provide quick access to cash in case of emergencies or unexpected expenses.

In South Africa, easy payday loans are typically offered by online lenders who provide quick approval and disbursement of funds. Borrowers can apply online, receive approval within minutes, and have the money deposited into their bank account the same day.

Eligibility requirements for easy payday loans in South Africa usually include being a South African citizen or permanent resident, having a regular income, being over 18 years old, and having a valid bank account.

The amount you can borrow with a payday loan in South Africa varies depending on the lender and your income level. Typically, payday loans range from R500 to R8000, with some lenders offering higher amounts for repeat borrowers with a good repayment history.

Fees and interest rates for easy payday loans in South Africa can vary depending on the lender. Typically, lenders charge a fixed fee per R100 borrowed, along with interest rates ranging from 20% to 60% per month.

If you can't repay your payday loan on time, you may incur additional fees and interest charges. Some lenders may offer extensions or payment plans to help you repay the loan, while others may report your non-payment to credit bureaus, affecting your credit score.